This year, consumers whose adjusted gross income is $73,000 or less can use products in the IRS Free File Program, which are offered by several different companies, to file their federal tax return and, in some instances, state tax return, entirely for free.

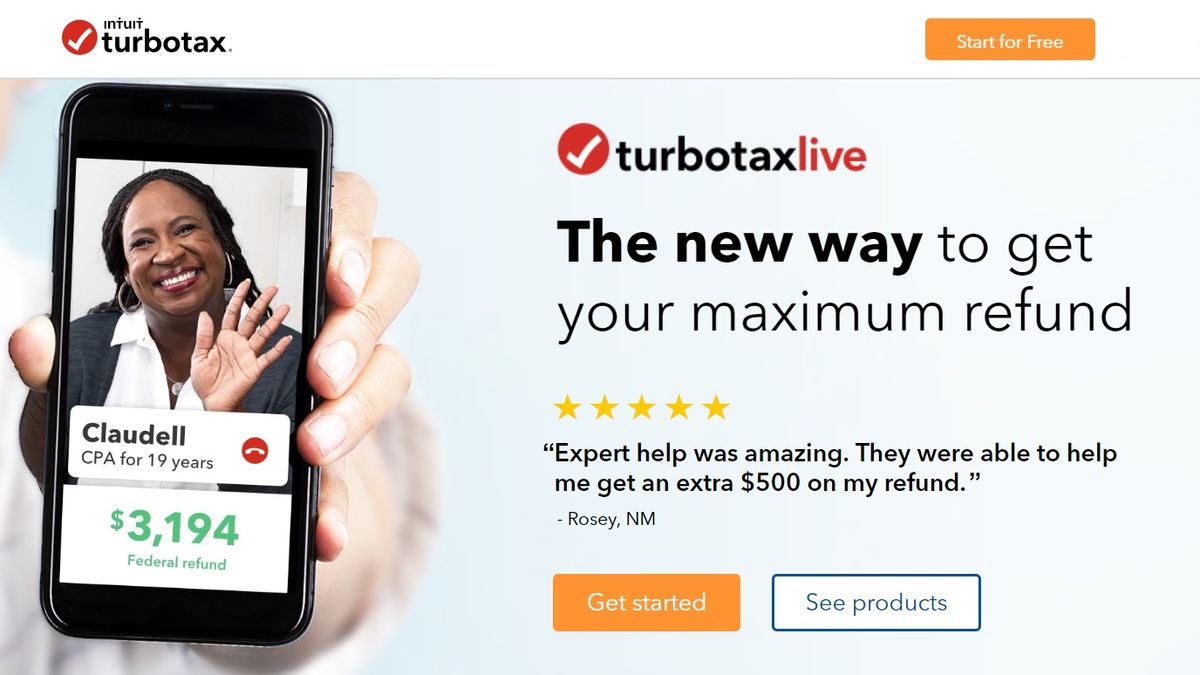

In spite of this advertising, many consumers who took the time to gather their documents, entrust their personal information to Intuit, and begin the filing process found that they could not file their taxes for free.įor example, in at least one ad a disclaimer appeared on the screen while an announcer said “That’s right, TurboTax Free is free. These ads have run during major events, including the Super Bowl, and have also aired during this year’s NCAA Basketball Tournament: “We are asking a court to immediately halt this bait-and-switch, and to protect taxpayers at the peak of filing season.”Īs detailed in the complaint, Intuit engaged in a years-long marketing campaign centered on the promise of “free” services. “TurboTax is bombarding consumers with ads for ‘free’ tax filing services, and then hitting them with charges when it’s time to file,” said Samuel Levine, Director of the Bureau of Consumer Protection. In 2020, for example, approximately two-thirds of tax filers could not use TurboTax’s free product. In fact, most tax filers can’t use the company’s “free” service because it is not available to millions of taxpayers, such as those who get a 1099 form for work in the gig economy, or those who earn farm income.

Filing with turbotax review for free#

The Commission alleges that the company’s ubiquitous advertisements touting their supposedly “free” products-some of which have consisted almost entirely of the word “free” spoken repeatedly-mislead consumers into believing that they can file their taxes for free with TurboTax. In addition, to prevent ongoing harm to consumers rushing to file their taxes, the Commission also filed a federal district court complaint asking a court to order Intuit to halt its deceptive advertising immediately. The Federal Trade Commission is taking action against Intuit Inc., the maker of the popular TurboTax tax filing software, by issuing an administrative complaint against the company for deceiving consumers with bogus advertisements pitching “free” tax filing that millions of consumers could not use. About the FTC Show/hide About the FTC menu items.News and Events Show/hide News and Events menu items.Advice and Guidance Show/hide Advice and Guidance menu items.Competition and Consumer Protection Guidance Documents.Enforcement Show/hide Enforcement menu items.A few examples are mailing a paper return, not choosing direct deposit, having errors on a return, missing documentation, and returns identified for additional review. Various things can delay return processing. The majority of these refunds are issued before the end of May. The Department issues $825 million in individual income tax refunds per calendar year. Please check your refund status at Where's My Refund. The anticipated time frame for refund processing is 30 days. When your return is complete, you will see the date your refund was issued. Taxpayer Services will not be able to provide further information if you call. The information on Where's My Refund, available on our website or over the phone at 51 or 80, is the same information available to our Taxpayer Service representatives. If you submitted your return electronically, please allow up to a week for your information to be entered into our system. Use Where's My Refund to check the status of individual income tax returns and amended individual income tax returns you've filed within the last year.īe sure to use the same information used on your return: Social Security Number, Tax Year, and Refund Amount. Track Your Refund About Where's My Refund

0 kommentar(er)

0 kommentar(er)